Chain Reaction

Chain Reaction

Additive manufacturing, also known as 3-D printing, is a win-win for people who restore classic cars and the companies that made them.

Take for example the Porsche 959, the world’s fastest street car when introduced in 1987. Only 292 were ever made and spare parts are either scarce or nonexistent.

When inventories ran out, Porsche would pull out old tooling and make a small batch for future use. This year, however, Porsche announced it would begin scanning several parts into CAD models and print them on demand, a faster and less costly process.

Porsche is not the only automaker doing this. Mercedes-Benz makes 30 additive spares parts for older Daimler trucks. And Volvo has introduced some parts as well.

These parts mark the auto industry’s first tentative steps in using additive manufacturing to fill its supply chain. They certainly won’t be the last.

While additive manufacturing is usually the most expensive way to make any part, it makes economic sense for supply chains. Which is why manufacturers of everything from aircraft and rolling stock to appliances, industrial equipment, and medical devices are looking at 3-D supply chain solutions—as are the U.S. Marines and UPS.

Today’s global supply chains begin with raw materials and parts used to build products and extend to the distribution and storage of spare parts for service. They vary in length and complexity. An industrial pump or motor might have scores of parts, a car 30,000, and a jetliner 3 to 4 million.

Manufacturers must make spare parts for all of them. So, they make extras during production, when tooling is in place and parts cost less to manufacture. Then they go into inventory.

You May Also Like: Manufacturing Special Report

Some parts, like bearings, motor windings, and brake pads, are always in demand. They return their initial investment quickly. Others stay in storage for decades on end. In fact, logistics giant DHL believes excess and rarely used stock may sometimes total more than 20 percent of all inventory. That’s expensive.

Additive manufacturing promises to address those problems and more. Additive can make parts to order from digital files that cost pennies to store on servers. It can also consolidate multiple parts and fasteners into a handful to integrated structures that simplify sourcing.

On the factory floor, it can slash the time needed to order tools, jigs, and fixtures. And because additive machines are so flexible, they can act like baseball’s utility infielders and pick up the slack when other machines or vendors go down.

At least, that’s the promise. For 30 years, additive manufacturing has made all sorts of promises. Yet machines remained slow, materials expensive, and printers too inconsistent for critical parts. And additive was costly.

Today, however, the technology is turning the past on its head.

A New Dawn for Additive

Additive works by printing parts from digital models, layer by layer, without molds or tooling. It excels at complex parts—lightweight brackets, radically shaped junctions, and conformal cooling channels—that could not be made any other way.

“The sweet spot for 3-D is when parts are complex, light weight, for add functionality,” said Terry Wohlers, the industry’s best-known consultant.

Additive manufacturing is almost always the most expensive way to make parts. Industry happily paid the price for prototypes, which save money by helping engineers find and address flaws before committing to production. Yet, additive struggled to break into manufacturing, where cost matters.

A sudden blossoming of new technologies has changed that. As patents expired, new competitors and startups—funded by $700 million in venture capital over the past few years—entered the market. Many of these new technologies are faster, more capable, and more affordable than ever before.

Take, for example, startup Carbon’s system to make mesh midsoles for Adidas sneakers. It uses lasers to solidify liquid polymers and heat to customize their mechanical properties.

The process takes minutes and yields an intricate mesh of 20,000 individually tuned struts that control impact and energy transfer when running. Adidas expects to sell more than 100,000 pairs of sneakers this year and millions in 2019.

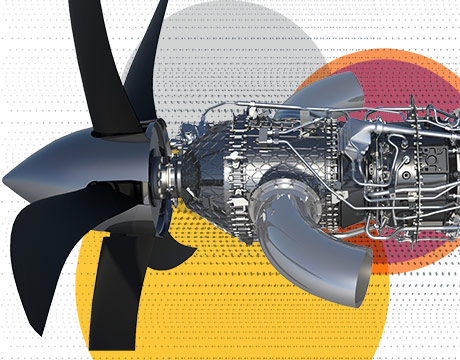

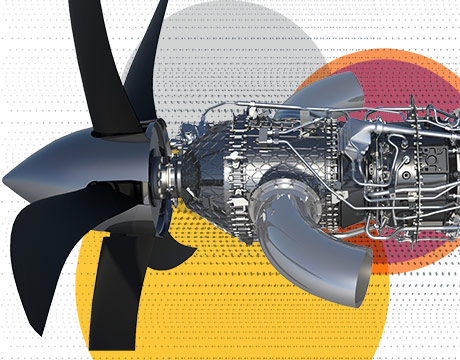

Designers are also learning to tap additive’s ability to make complex parts economically. The best-known example is GE Aerospace’s fuel injector nozzle for its LEAP turbofan jet engine, which was approved for flight by Federal Aviation Administration in 2015.

“The team redesigned it to create intricate cooling passages that would have been difficult to manufacture,” Steve Taub, managing director of GE Ventures, said. “This meant we could run hotter, which had a tremendous impact on the whole engine. The part performed better, was more durable, used less fuel, and costs less.”

GE plans to eventually ramp up production to 40,000 to 50,000 units.

GE’s latest propeller engine goes further. Using additive manufacturing, GE consolidated 855 parts into just 12 components. This slashed weight by 5 percent and lowered fuel burn by 20 percent—while reducing production and assembly costs.

Parts are starting to show up in low-volume applications. Boeing and Airbus aircraft use tens of thousands of 3-D interior parts, as well as a handful of low-risk structural parts. BMW is printing a metal part to raise and lower the i8 Roadster’s convertible roof. Stryker has invested $400 million in a new 3-D facility to make medical implants.

Only a few years ago, it was cheaper to switch to injection molding after a few thousand parts. Today, Wohlers likes to show off a small black spindle with two gears. An HP 3-D printer can churn out about 100,000 units before molding makes sense, he said.

After years of knocking at the door, additive manufacturing is finally entering the mainstream. For every company that has taken a first step, there are dozens looking for applications. Often, they focus on supply chains.

Chain Links

Today’s 3-D printed parts will be stored digitally and printed on demand in the future. It also makes sense to scan some older parts and print them to order rather than hold them in inventory. The same is true for parts that rarely fail, but that producers must stock “just in case.”

Additive is also cost-effective to repair customized industrial equipment, such as pumps that have been in service for decades where tooling (or the original producer) no longer exists.

Virtually every large automaker, aerospace firm, and appliance maker, and industrial company is considering these use cases today, Wohlers said. Their attraction is as diverse as their productions.

For example, Stanley Black & Decker needed to replace a hydraulic pump actuator for a post driver made 20 years ago. The company redesigned the piece to be one part and cut production costs by using a Markforged 3-D metal printer.

“It might take six weeks and $1,000 to manufacture a part that is out of stock,” explained Andrew de Geofroy, vice president of application engineering at Markforged. “If the part broke, the machine could be down for weeks. With 3-D printing, they can replace it faster and at a lower cost.”

The Marine Corps, on the other hand, values additive’s flexibility, said Capt. Matthew Friedell, additive manufacturing lead at the Marine’s main acquisition command.

“If I have a mission and take two spare water pumps, they only can do a water pump function,” he said. “But if I bring eight pounds of powdered aluminum instead, I can make 300 parts that might break down. It will greatly affect the supply chain, and how we maintain our vehicles and systems going forward.”

Boeing, meanwhile, uses additive to make custom tooling and fixtures used to speed machining and assembly. These shop floor fixes are essential as Boeing ramps of the production of its latest 737 to 57 airplanes per year.

“If a mechanic needed a tool, a designer would create it and send it out,” said Nyle Miyamoto, Boeing Commercial Airplanes’ chief engineer for additive manufacturing. “That could take months, and that’s too slow.

“On the new line, we will have cells on the floor for designers to create and print these parts. They can cut hundreds of hours off fitting large parts together, and we can now turn them into reality overnight.”

Thinking Bigger

Yet de Geofroy calls the ability to print replacement parts faster and cheaper “table stakes,” the bare minimum needed to make additive manufacturing a supply chain player.

“It’s only when you understand the secondary benefits that you see 3-D’s true transformational effects,” he said. “That’s what’s driving larger customers to embrace additive.”

After surveying 38 German manufacturers, international business consultant PwC agrees. Additive makes sense, but only if “companies factor in its effects on the entire supply chain, and ultimately the total cost of ownership as well as the potential benefits of radical changes in product design.”

PwC imagines a system where customers or suppliers order spare parts from a manufacturer’s web page. Within hours, nearby 3-D service bureaus have downloaded the files, printed the parts, and sped them to the customer. Or the customer prints parts on its own equipment, eliminating shipping costs, tariffs, and delays.

For industry, faster spares mean more machine uptime and fewer production disruptions. For consumers, they mean less waiting for someone to repair a car or appliance.

Vendors also gain. They improve customer service, and they can slash inventories without worrying about disrupting production to produce spare parts. By redesigning parts for additive (like Stanley), they can reduce production costs and deliver parts that need no on-site assembly. PwC estimates that additive could help ultimately save manufacturers 20 percent in total cost of ownership of spare parts.

Yet half the firms PwC interviewed remained skeptical about logistics savings. UPS, one of the world’s largest manufacturing logistics companies, begs to differ.

UPS’s vice president of corporate strategy, Alan Amling, sees a world where “goods will be produced in lower quantities and more frequently, closer to the point of consumption.”

That threatens UPS’s industrial storage and shipping business. To stay ahead of the curve, UPS partnered with enterprise software giant SAP and additive manufacturer Fast Radius to roll out industrial 3-D printers globally, starting with its Supply Chain Solutions facility in Louisville, Ky.

“If we get a call for a part at 5 p.m. and it takes seven hours to print it, we can still get that part anywhere in the United States by 8 a.m. the next morning,” Amling said. “We really do not see this as a manufacturing solution, but as a supply chain solution.”

UPS saw the light when it analyzed its critical service parts logistics business, whose 1,000 warehouses provide local storage and fast delivery for essential parts.

“Those parts are in our inventory, and we know that a lot of them turn very slowly or not at all,” Amling said. “It’s a huge cost for our customers, but they have to have them, just in case, right? So, when additive manufacturing started to go beyond prototypes, we decided that we needed to get in the game.”

Transformation

In a 2015 paper, Timothy Simpson, a professor of mechanical engineering at Pennsylvania State University, and Irene Petrick, Intel’s director of corporate strategy, argued that additive’s “economies of one” could change manufacturing forever, and even blur the lines between production and supply chain.

“Since the days of Henry Ford, it’s all been about economies of scale,” Simpson said. “The more you can produce, the more units you can amortize your cost over, and the cheaper things are to make.

“But, with additive manufacturing, there are opportunities to produce things economically in smaller quantities. If you take this to the extreme, then you really are able to manufacture things one at a time, hence, ‘economies of one.’?”

And 3-D printing makes it possible to not only manufacture those parts but support them in the field.

Simpson envisions a world where corporations no longer kill good ideas because they cannot generate enough volume: “Instead, you can greenlight new products, take more risks, go after niche markets, do all sorts of things that you might not have done before,” Simpson said.

He expects more customization. A pump company could develop impellers for different viscosities, flow pressures, and temperatures. These might boost performance enough to justify a premium price.

In fact, customization could make manufacturing a service. A running store could measure a customer’s foot and stride and deliver a custom pair of sneakers in a day or two.

Simpson also believes engineers will increasingly embed opportunities for customization into designs.

GE’s Taub agrees: “We actually do that today, with conventional manufacturing processes. In businesses like aviation and power, there are services that provide upgrades and modifications that improve performance. Additive just allows us to do it faster and with less risk on our side because we don’t have to invest in tooling.”

Still, challenges remain. Hardware must get better and faster, and materials more economical, for 3-D to see widespread use. Vendors are moving in that direction, but still have a way to go.

Additive machining must also face up to post-processing costs. Most 3-D parts use support structures to stabilize layers. Users must separate the parts and finish them using solvents and conventional machining. This can take 10 or more different steps, including disposal of dangerous wastes and such exotic finishing processes as hot isostatic pressing for metal aerospace parts. Wohlers estimates that post-processing accounts for 70 percent of 3-D part cost.

Then there is software. A common complaint among users is that 3-D printers offer more capabilities than CAD software can model.

This is changing, said Jose Coronado, manufacturing and simulation product manager at PTC, an engineering software company. PTC’s latest Creo CAD software offers several tools for additive designers.

One is topology optimization, which converts blocky conventional parts into flowing meshes that weigh less and use less materials. Another integrates simulation with design, so engineers can see how design changes affect part performance.

“The simulation runs all the time and enables designers to replace assumptions about behavior during use with facts,” Coronado said.

And, finally, the industry needs more use cases, said Wohlers: “It’s like the chicken and the egg. Everyone is looking for use cases to justify 3-D, but they need an existing use case to prove it will work.”

Given all the ways additive can transform the supply chain, from simplified aircraft engines to spare parts for restored cars, those case studies are sure to follow. And what comes next is anyone’s guess. ME

Alan s. brown is a senior editor at Mechanical Engineering magazine.

Also read: A Special Report on Additive Manufacturing